It's not often I get nostalgic, but every once in a while, I harken back to my days in the Revenue (now "HMRC") and in practice as a tax consultant; to a time when the…

It's not often I get nostalgic, but every once in a while, I harken back to my days in the Revenue (now "HMRC") and in practice as a tax consultant; to a time when the…

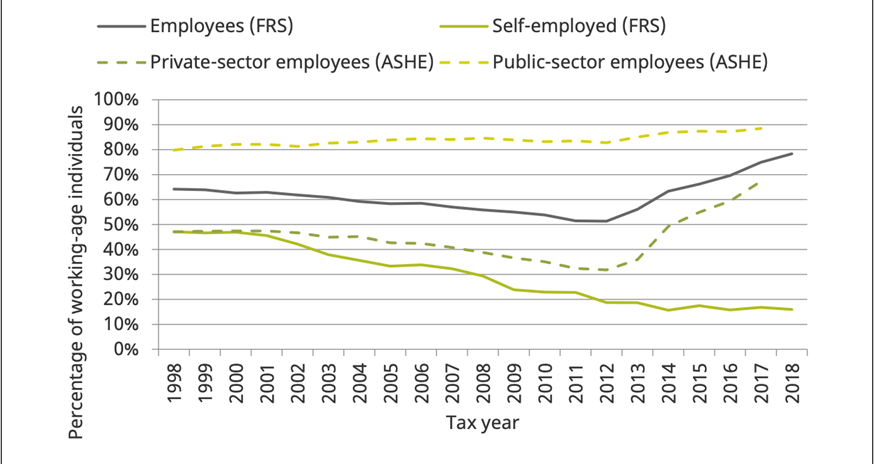

My regular readers will know that I like to ponder out loud, my meandering musings in my blogs, so they won't be surprised I've come up with another quick quiz: Are you self-employed? If so,…

To assist taxpayers, HMRC has launched an online portal for the making of working from home expenses incurred during the pandemic. From 6 April 2020, employees can claim a tax-free amount of £6 a week…

Two further grants under the SEISS were announced in September and have now been updated. Following the announcement last week, of a second lockdown, the government’s new package of support measures announced in the Chancellor’s…

With the announcement of another national lockdown, the furlough scheme has been extended for a further month from 1 November until 2 December. The extension of financial support under the Coronavirus Job Retention Scheme (CJRS)…