Self-employed workers will see a substantial reduction in their Class 4 national in announced in the 202surance contributions (NICs) for the current tax year after two percentage cuts were 3 Autumn Statement and 2024 March…

Self-employed workers will see a substantial reduction in their Class 4 national in announced in the 202surance contributions (NICs) for the current tax year after two percentage cuts were 3 Autumn Statement and 2024 March…

A useful new web tool has emerged, a little late in the game, in a joint effort from two government departments. In early 2023, HMRC and the Department for Work and Pensions (DWP) found they…

Around 1.1 million taxpayers who failed to submit the self assessment tax return for 2022/23 on 31 January 2024 now face a £10 daily penalty charge by HMRC. HMRC has imposed a daily penalty of…

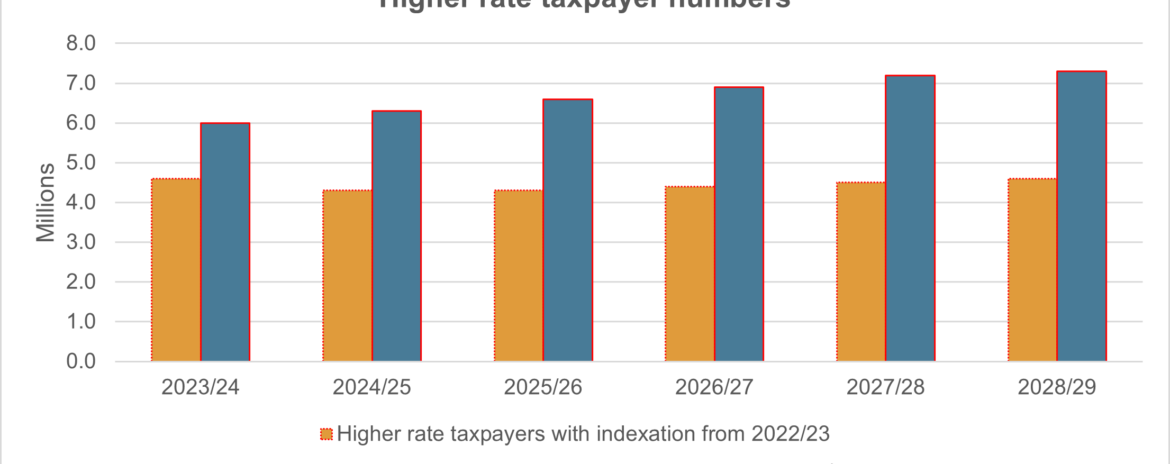

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

From 2024/25, restrictions to the cash basis will be removed, making it the default method for calculating trading profit for the self-employed and most partnerships. The accruals basis is currently the default, with a business…

National insurance contribution (NIC) changes for the self-employed announced in the Autumn Statement come in from 6 April 2024 and will be welcome news. But the reforms don’t go far enough to offset the continuing…

The 31 January 2024 deadline for submitting a 2022/23 self-assessment tax return is not far off, especially for those not yet registered. Anyone who has not previously registered for self-assessment – but needs to submit…

There is a long list of reasons why it is necessary to complete a self-assessment tax return, but PAYE taxpayers are generally exempt from the requirement. Previously, exemption was subject to a £100,000 income ceiling,…

From 1 July, the energy price cap set by energy regulator, Ofgem, will fall from £3,280 to £2,074. Prices are currently capped at £2,500, but this further reduction will help home-based employees and any small…

If you are self-employed, the new tax year may be longer than you think. If you are self-employed, until 2023/24, you have normally been taxed on the profits made in the accounting year that ends…