The tax gap increased in 2022/2023, to a record £39.8 billion, with small businesses being blamed for around 60% of uncollected taxes. The tax gap is the difference between the amount of tax that should,…

The tax gap increased in 2022/2023, to a record £39.8 billion, with small businesses being blamed for around 60% of uncollected taxes. The tax gap is the difference between the amount of tax that should,…

Self-employed workers will see a substantial reduction in their Class 4 national in announced in the 202surance contributions (NICs) for the current tax year after two percentage cuts were 3 Autumn Statement and 2024 March…

It’s early days yet, but some pointers on tax have emerged from both the main parties. Within one week of the surprise firing of the general election starting gun, both the Conservatives and Labour have…

With allowances frozen or cut, you may have underpaid tax for 2023/24. Your tax position may have changed for the last year without you really noticing. Consider the following: Tax Year 2021/22 2023/24 2024/25 Personal…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

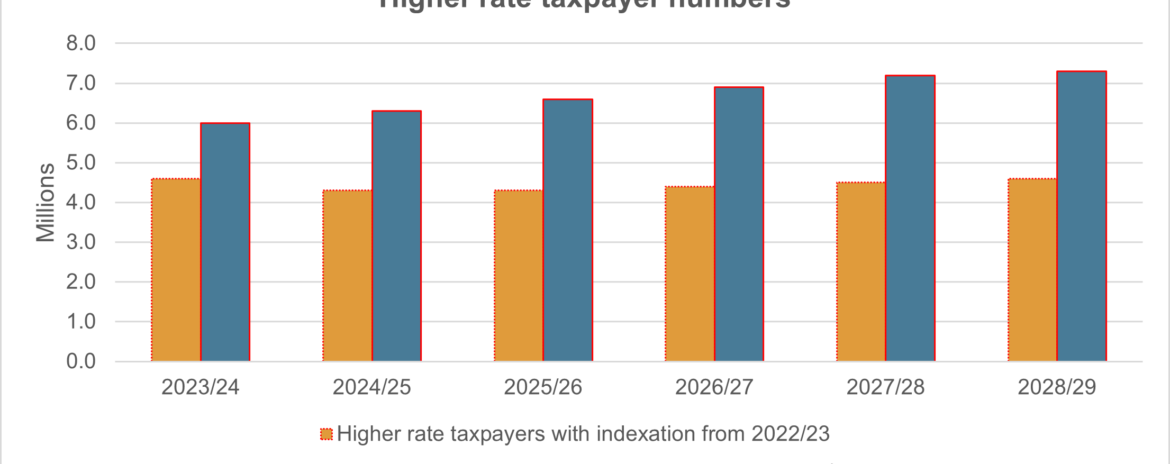

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

The media storm surrounding HMRC taxing eBay and other online sellers from the start of 2024 was, in fact, itself counterfeit goods. A crop of stories across social and traditional media swirled across the start…

With tax bands and other thresholds frozen, taxpayers should be aware of the implications of their income increasing. Increased income can mean more than facing a higher tax bill. Higher rate taxpayers need to look…

From 2024/25, restrictions to the cash basis will be removed, making it the default method for calculating trading profit for the self-employed and most partnerships. The accruals basis is currently the default, with a business…

National insurance contribution (NIC) changes for the self-employed announced in the Autumn Statement come in from 6 April 2024 and will be welcome news. But the reforms don’t go far enough to offset the continuing…