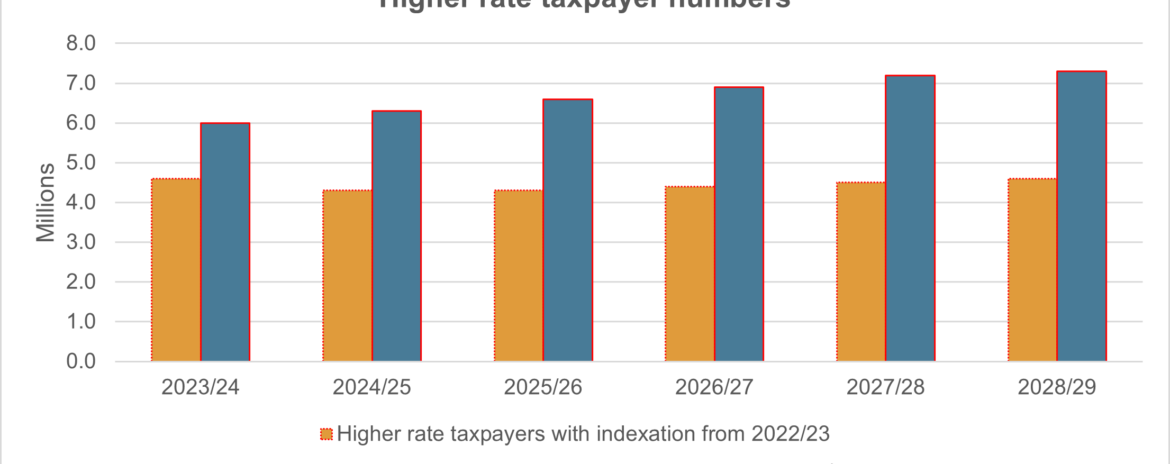

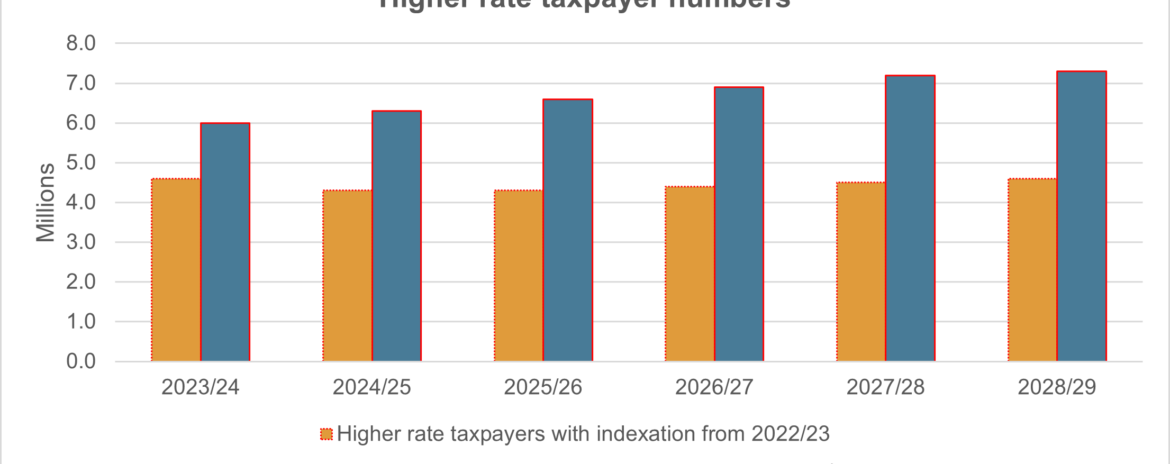

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

Perhaps not as widely known as the much publicised changes to company law is the fact that due to an increase in charges levied by Companies House, fees associated with incorporating and maintaining a company…

There’s no respite for HMRC with inheritance tax (IHT) accounts, undeclared dividend income and gains from share disposals to scrutinise. HMRC is currently busy with several ongoing checks. They are looking at IHT accounts, targeting…

New HMRC statistics have shed some light on how many companies are affected by the recent hike in corporation tax rates. Just over 1.5 million companies paid corporation tax for the financial year to 31…

Directors who abuse the company dissolution process in order to evade debts, including the repayment of government-backed Covid-19 business loans, will be subject to stronger powers given to the Insolvency Service. These new powers were…