For owner-managed companies, bonuses, dividends and remuneration will become yet more complex in the new tax year. With the corporation tax increase and dividend rates now confirmed by the Government, the dividend vs remuneration decision…

For owner-managed companies, bonuses, dividends and remuneration will become yet more complex in the new tax year. With the corporation tax increase and dividend rates now confirmed by the Government, the dividend vs remuneration decision…

The private sector off-payroll working rules have been in place since April 2021, but for the first 12 months businesses have benefitted from HMRC’s relaxed stance on penalties. HMRC will now, however, penalise mistakes made…

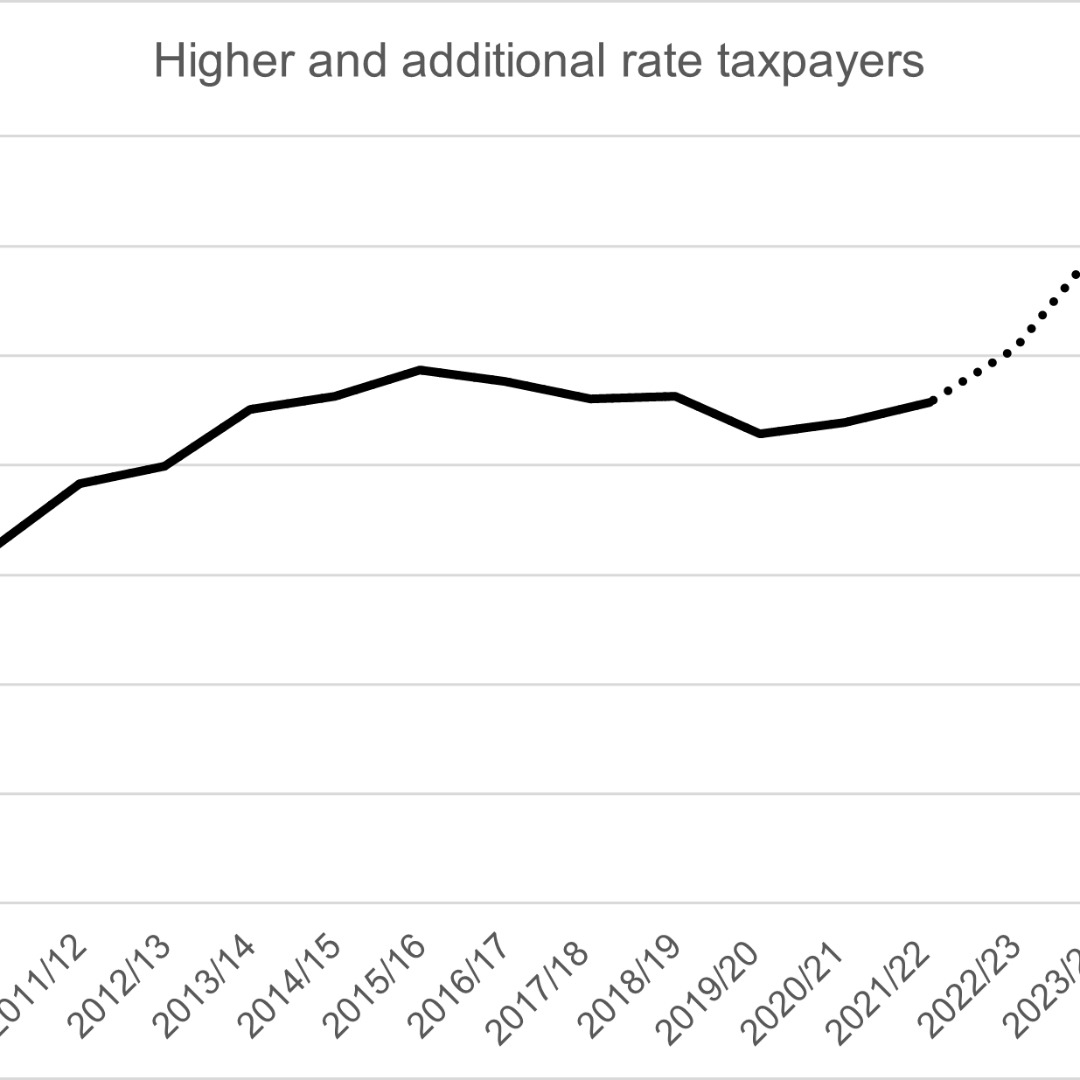

......and if that’s you, then advice is now more important than ever. There was once a time when paying tax at more than the basic rate made you a member of a somewhat select club.…

The off-payroll working (IR35) tests are still relevant despite the blanket approach often in place regarding contractors’ employment status. They must always be applied if you are contracting for a small organisation. Two recent decisions…

Contractors have turned to umbrella companies as a hassle-free way of providing their services to clients following the recent changes to the off payroll working rules. They receive no tax savings, but pass on some…

....for it is knell that summons thee to heaven or to hell." I know: not quite the cheerful entry to a blog, however, those immortal words from my favourite Shakespeare play: uttered by Macbeth on…