A new points-based penalty applies to late VAT returns for VAT periods beginning on or after 1 January 2023. The first monthly return to be affected was the one due by 7 March 2023, with…

A new points-based penalty applies to late VAT returns for VAT periods beginning on or after 1 January 2023. The first monthly return to be affected was the one due by 7 March 2023, with…

Most directors and employees will already have been issued a tax code for the 2023/24 tax year, and it is important to check the figures as a very large proportion of codes will be incorrect.…

It wasn’t that long ago that HMRC was paying particular attention to businesses understating large cash sales. Now, the decline of cash, especially since Covid-19, has led to a proliferation of software used to suppress…

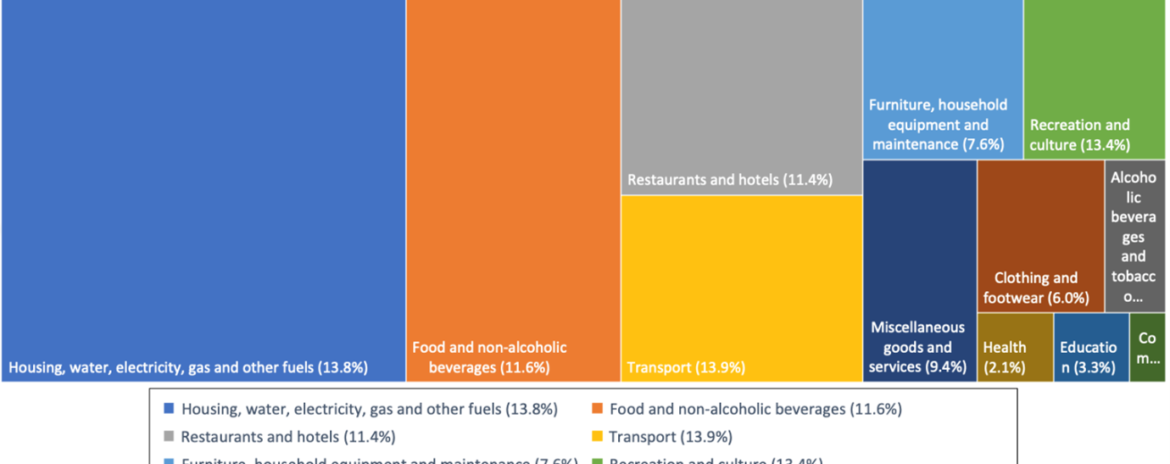

Annual inflation, as measured by the Consumer Prices Index (CPI), was 10.5% in 2022 against 5.4% in 2021. The official CPI calculator, the Office for National Statistics (ONS), says that the last time inflation was…

HMRC’s app was launched a year ago and is gaining in popularity as it is being used to pay self-assessment tax bills. A more recent HMRC innovation is a new service for texting replies to…