Self-employed workers will see a substantial reduction in their Class 4 national in announced in the 202surance contributions (NICs) for the current tax year after two percentage cuts were 3 Autumn Statement and 2024 March…

Self-employed workers will see a substantial reduction in their Class 4 national in announced in the 202surance contributions (NICs) for the current tax year after two percentage cuts were 3 Autumn Statement and 2024 March…

Taxpayers will benefit from the changes made to the high income child benefit charge thanks to all tax measures from the March 2024 Budget being enacted before parliament was prorogued. Changes to benefit charge For…

A useful new web tool has emerged, a little late in the game, in a joint effort from two government departments. In early 2023, HMRC and the Department for Work and Pensions (DWP) found they…

It may seem counter-intuitive, but taking a pay cut and opting for a salary sacrifice scheme with an electric car can boost take-home pay thanks to tax and national insurance contribution (NIC) savings. Salary sacrifice…

With allowances frozen or cut, you may have underpaid tax for 2023/24. Your tax position may have changed for the last year without you really noticing. Consider the following: Tax Year 2021/22 2023/24 2024/25 Personal…

Around 1.1 million taxpayers who failed to submit the self assessment tax return for 2022/23 on 31 January 2024 now face a £10 daily penalty charge by HMRC. HMRC has imposed a daily penalty of…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

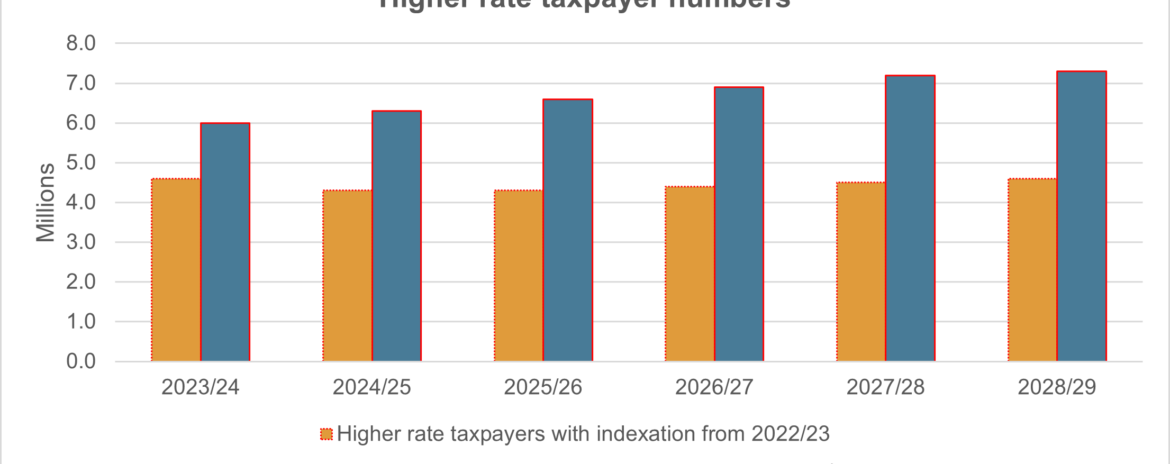

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

The media storm surrounding HMRC taxing eBay and other online sellers from the start of 2024 was, in fact, itself counterfeit goods. A crop of stories across social and traditional media swirled across the start…