The COVID-19 pandemic stalled property transactions and first-time buyer mortgage applications, but now the residential property market has opened up estate agents are scrambling to deal with pent up demand. Price outlook The range of…

The COVID-19 pandemic stalled property transactions and first-time buyer mortgage applications, but now the residential property market has opened up estate agents are scrambling to deal with pent up demand. Price outlook The range of…

A new Corporate Insolvency and Governance Bill, introduced on 20 May, will amend insolvency and company law to support businesses in distress from the impact of the COVID-19 pandemic. The Bill, to be fast-tracked through…

HMRC’s recent suspension of IHT investigations during the Covid-19 crisis opens up a brief opportunity for executors to get their IHT accounts in order. HMRC normally investigates around 5,500 IHT cases every year, around 25%…

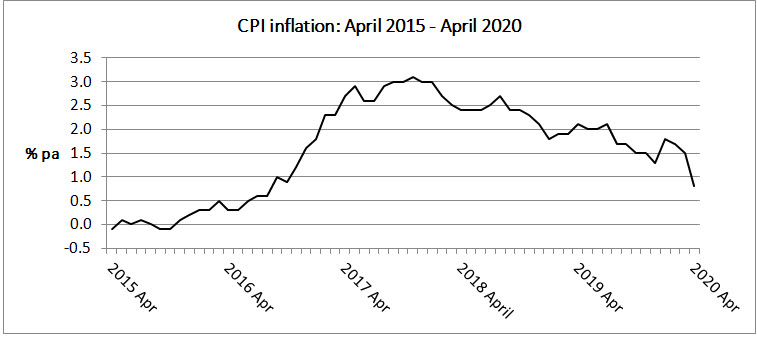

The disappearance of normal spending habits has created problems for the statisticians who calculate the rate of inflation. Source: Office for National Statistics Inflation, as measured by the Consumer Prices Index (CPI), fell sharply in…

HMRC is allowing your second self-assessment payment due on 31 July 2020 on account for the tax year 2019/20 to be deferred, due to the Covid-19 pandemic. This means no interest or penalties will be…

The adoption in the UK of a transatlantic approach to income tax could appeal to a cash-strapped Chancellor. “…only the little people pay taxes.” That 1980s comment by the New York Hotel owner Leona Helmsley…

The Covid-19 furlough scheme has been effectively revised into a new scheme running from 1 July until 31 October, but this comes with a level of complexity that did not exist in its original guise.…

The state pension triple lock may not survive much longer. The impact of Covid-19 on earnings could mean a change in the way that state pensions are increased in each year. If nothing is done,…

Help for consumers to manage their credit and debt has been extended to the end of October. In mid-June, the Financial Conduct Authority (FCA) told firms to extend measures to provide help to people with…

When making tax payments to HMRC, you are currently only charged a fee if you pay by business credit card, while payments by personal credit card are not permitted. However, from 1 November 2020, payments…