With the government announcing there will be no van benefit charge for fully electric company vans from 6 April 2021, you might be forgiven for thinking that having a company electric vehicle avoids any tax…

With the government announcing there will be no van benefit charge for fully electric company vans from 6 April 2021, you might be forgiven for thinking that having a company electric vehicle avoids any tax…

Details of an ambitious ten-year strategy to create a tax system fit for the 21st century have been released alongside Finance Bill legislation. With the rapid growth of information and communications technologies, the aim is…

The Chancellor has asked the Office of Tax Simplification to review capital gains tax (CGT). Within a week of giving his Summer Statement, the Chancellor wrote to the Office of Tax Simplification (OTS) asking it…

At a point during the early days of the pandemic, this author, being of a certain age, weight, and ethnic group, took the decision to get his affairs in order – the Coronavirus intensely on…

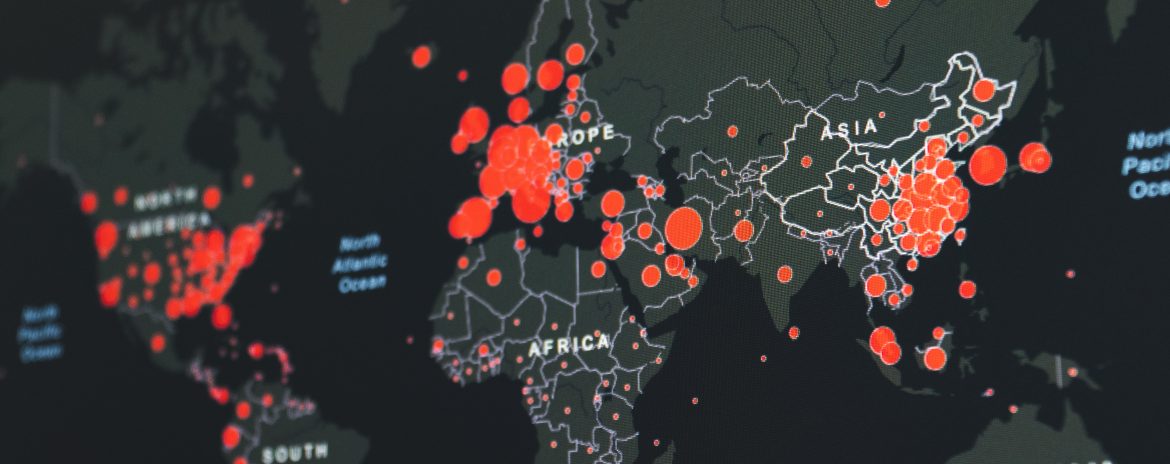

The global COVID-19 pandemic may be with us for a while yet and as such, I would like to take the opportunity to assure my clients (and potential clients) that as my practice is cloud-based,…

The government committed to undertake a fundamental review of business rates in England at the Spring Budget. It has now issued a call for evidence, with views on reliefs and the ‘multiplier sort’ by 18…