HMRC has updated its guidance to clarify that there is no taxable benefit when an employer reimburses employees who charge their electric company cars at home. Previously, HMRC maintained that the relevant exemption did not…

HMRC has updated its guidance to clarify that there is no taxable benefit when an employer reimburses employees who charge their electric company cars at home. Previously, HMRC maintained that the relevant exemption did not…

The 31 January 2024 deadline for submitting a 2022/23 self-assessment tax return is not far off, especially for those not yet registered. Anyone who has not previously registered for self-assessment – but needs to submit…

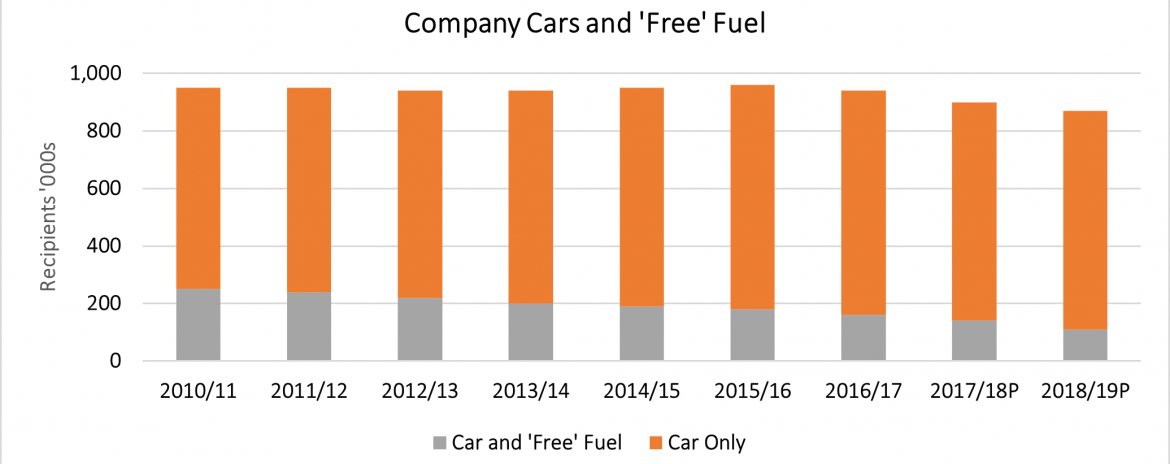

If your employer pays for the fuel in your company car, it may cost you more than you expected. As the Autumn Statement was not a Budget, detailed publications that would normally emerge as the…

It's not often I get nostalgic, but every once in a while, I harken back to my days in the Revenue (now "HMRC") and in practice as a tax consultant; to a time when the…

The tax treatment of cars and vans is quite different, with van classification far more beneficial from both an employer and employee perspective. However, the distinction is not always clear-cut, especially where vans have been…

With the government announcing there will be no van benefit charge for fully electric company vans from 6 April 2021, you might be forgiven for thinking that having a company electric vehicle avoids any tax…