As some of you will recall, a few months ago, following an increase in the number of insolvency-related inquiries, I reached out to my LinkedIn contacts for help in finding professionals to join my team…

As some of you will recall, a few months ago, following an increase in the number of insolvency-related inquiries, I reached out to my LinkedIn contacts for help in finding professionals to join my team…

It may seem counter-intuitive, but taking a pay cut and opting for a salary sacrifice scheme with an electric car can boost take-home pay thanks to tax and national insurance contribution (NIC) savings. Salary sacrifice…

With allowances frozen or cut, you may have underpaid tax for 2023/24. Your tax position may have changed for the last year without you really noticing. Consider the following: Tax Year 2021/22 2023/24 2024/25 Personal…

HMRC has recently published guidance to provide greater clarity about the tax deductibility of training costs for the self-employed. Apart from updating current skills, costs are also deductible if they provide new skills or knowledge…

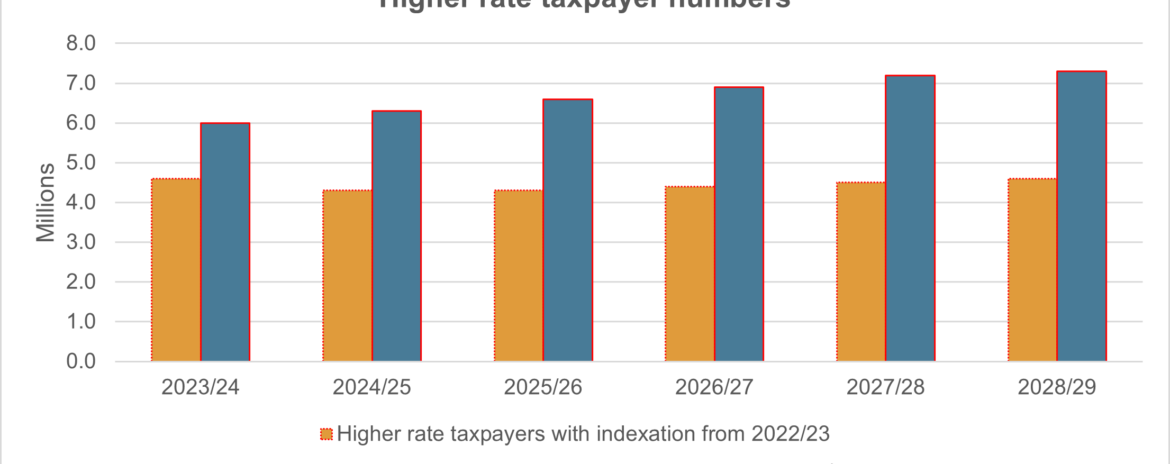

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

With tax bands and other thresholds frozen, taxpayers should be aware of the implications of their income increasing. Increased income can mean more than facing a higher tax bill. Higher rate taxpayers need to look…

Minimum wage rates will see substantial increases from 1 April 2024 – welcome news for younger workers and apprentices, but not so much for those employers struggling in the current economic climate. Eligibility for the…

HMRC has updated its guidance to clarify that there is no taxable benefit when an employer reimburses employees who charge their electric company cars at home. Previously, HMRC maintained that the relevant exemption did not…

Business owners could seek to earn interest on directors’ loans with little-to-no tax implications, although only patient directors willing to meet the reporting requirements will benefit. Even though the rate of interest charged by HMRC…

The government is extending the provision of 30 hours of free childcare for 38 weeks to now include all pre-school children over the age of nine months. Phased introduction The extended childcare provision will be…