While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

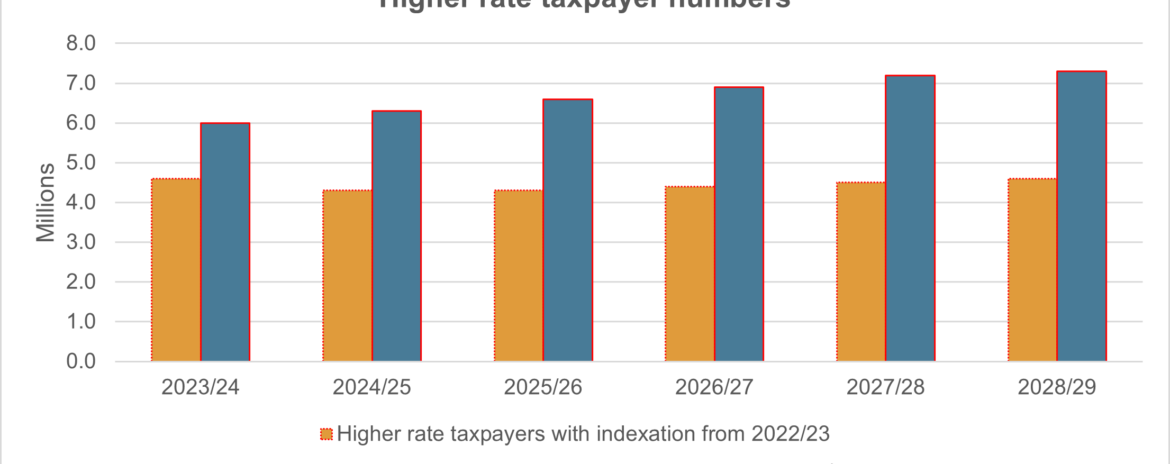

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

New research has put some surprising numbers on the income needed in retirement. Each year since 2019, the Pensions and Lifetime Savings Association (PLSA) has set about answering the question of how much retirement costs…

Perhaps not as widely known as the much publicised changes to company law is the fact that due to an increase in charges levied by Companies House, fees associated with incorporating and maintaining a company…