Most directors and employees will already have been issued a tax code for the 2023/24 tax year, and it is important to check the figures as a very large proportion of codes will be incorrect.…

Most directors and employees will already have been issued a tax code for the 2023/24 tax year, and it is important to check the figures as a very large proportion of codes will be incorrect.…

It wasn’t that long ago that HMRC was paying particular attention to businesses understating large cash sales. Now, the decline of cash, especially since Covid-19, has led to a proliferation of software used to suppress…

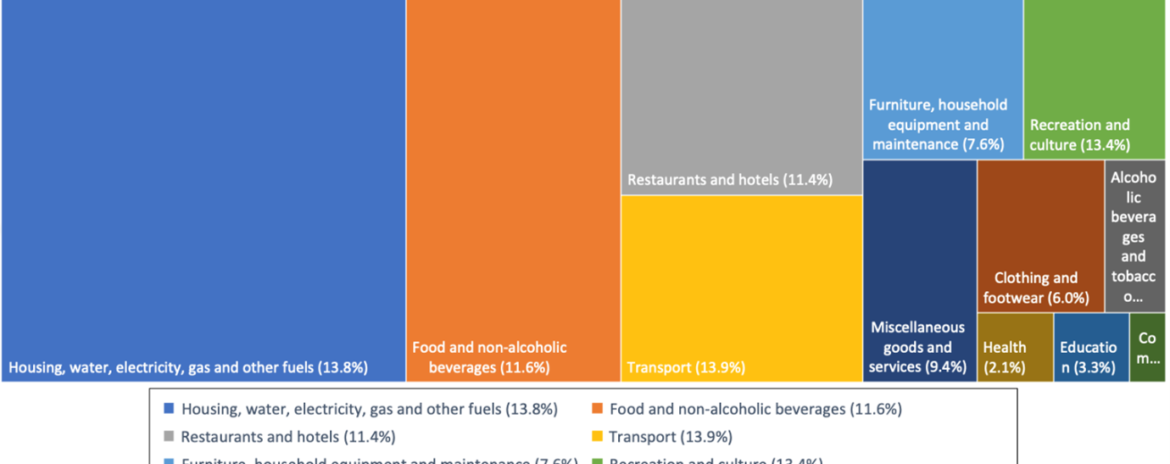

Annual inflation, as measured by the Consumer Prices Index (CPI), was 10.5% in 2022 against 5.4% in 2021. The official CPI calculator, the Office for National Statistics (ONS), says that the last time inflation was…

HMRC’s app was launched a year ago and is gaining in popularity as it is being used to pay self-assessment tax bills. A more recent HMRC innovation is a new service for texting replies to…

HMRC’s latest wave of ‘nudge letters’ – used to prompt a response from the recipient – has been targeted at online sellers, influencers and content creators warning them that they may not have paid enough…

Owner-managers have historically benefited by withdrawing profits by way of dividends, rather than taking director’s remuneration, due to the national insurance contribution (NIC) saving. However, tax changes taking effect from April 2023 will mean this…

A new business energy support scheme is set to run from 1 April 2023 to 31 March 2024 but will be less generous than the scheme currently in effect. Businesses with energy costs below £107/MWh…

If your employer pays for the fuel in your company car, it may cost you more than you expected. As the Autumn Statement was not a Budget, detailed publications that would normally emerge as the…

With property prices expected to fall during 2023, parents may be thinking about getting their children onto the property ladder. However, although help with a deposit does not raise that many tax issues, joint ownership…

With the self-employed and landlords facing a challenging economic environment, the government has again delayed the introduction of the Making Tax Digital (MTD) scheme for income tax self-assessment (ITSA) – this time by two years…