HMRC has decommissioned its interactive PDF that businesses have been using to submit up to 150 P11Ds. For 2021/22, former users will instead have to turn to HMRC’s PAYE online service or use commercial payroll…

HMRC has decommissioned its interactive PDF that businesses have been using to submit up to 150 P11Ds. For 2021/22, former users will instead have to turn to HMRC’s PAYE online service or use commercial payroll…

In late May, the Chancellor announced new measures to counter the rising cost of living, in particular energy prices. Initial measures for 2022 In early February 2022, the Chancellor announced a package of measures to…

Making Tax Digital (MTD) will become mandatory for the self-employed and landlords in 2024. Although there is no major news, a recent webinar co-hosted by HMRC has shed more light on the sign-up process, the…

A downside to running a limited company is that financial information is publicly available. However, micro-entities and small companies do not have to file a profit and loss account, so available information is somewhat restricted.…

The distinction between zero-rated food and standard VAT confectionery is a crucial, and complex, one – not helped by what may appear to be apparently arbitrary rulings. Despite its predecessor losing a notorious ruling over…

Rising prices hurt just about everyone, but small business owners face a double hit: the impact on their own spending power, but also less revenue coming in from cash-strapped customers. The volume of retail sales…

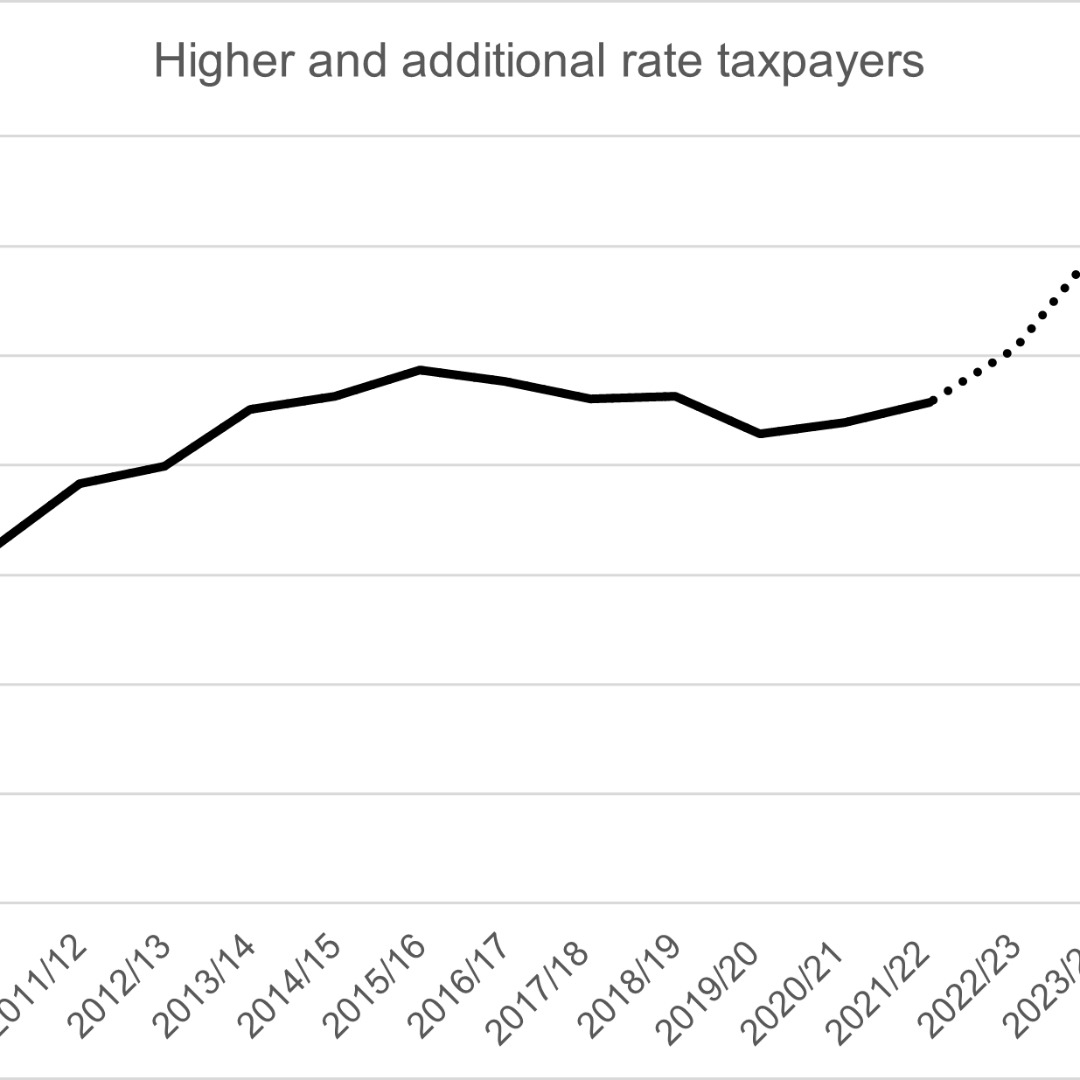

......and if that’s you, then advice is now more important than ever. There was once a time when paying tax at more than the basic rate made you a member of a somewhat select club.…

The pandemic has freed many workers from the confines of the office, leading to the emergence of a new breed of digital nomad – people who can take their laptop, jump on a plane and…

Around three quarters of those students who started full-time undergraduate degrees in 2020/21 are not expected to fully repay their student loans. However, changes starting with the 2023 student cohort will see many paying more,…

A critical review of how the government taxes child benefits has raised a major question mark over HMRC’s approach to collecting payments. Child benefit tax, or the High-Income Child Benefit Charge (HICBC) to use its…