I'm sitting here musing about the number of calls I'm still taking from (potential) clients regarding taking them on for this year's self-assessment submissions. It's got me thinking. Why do some people leave this to…

I'm sitting here musing about the number of calls I'm still taking from (potential) clients regarding taking them on for this year's self-assessment submissions. It's got me thinking. Why do some people leave this to…

Admittedly, this is coming to you a little later than planned, but hopefully, this blog will provide some useful insight into the measures introduced following the announcement on January 5th of the current national lockdown…

As the third Covid-19 lockdown took effect on 5 January 2021, the Chancellor announced a further £4.6 billion in grants to the retail, hospitality and leisure sectors. This new round of support follows extensions to…

A recent report could herald changes to capital gains tax. Last July the Chancellor asked the Office of Tax Simplification (OTS) to undertake a review of capital gains tax (CGT) “in relation to individuals and…

One of the announcements to come out of the Chancellor’s Spending Review was welcome increases to minimum wages. From 1 April 2021, the National Living Wage will get a 19p increase, going up to £8.91…

Applications for the third Self-Employment Income Support Scheme (SEISS) grant opened from 30 November, and you have until 29 January 2021 to make a claim. Be warned, however, that some of the conditions for this…

A recent survey of small businesses has revealed that only a quarter of them are confident of their survival into 2021, with many worried about cash flow. Those businesses that took out Bounce Back Loans…

One of my favourite quotes from the Bush II administration (and there were a few) is the famous quote from then Secretary of Defence, Donald Rumsfeld who famously said: "Reports that say that something hasn't…

It's not often I get nostalgic, but every once in a while, I harken back to my days in the Revenue (now "HMRC") and in practice as a tax consultant; to a time when the…

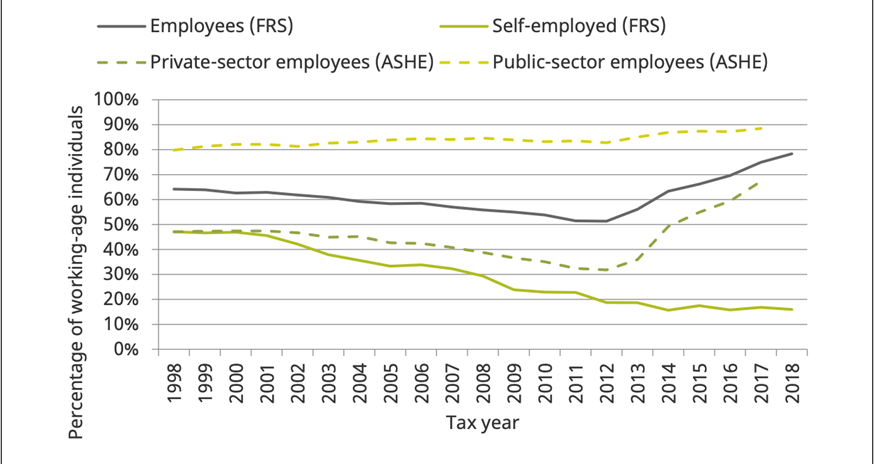

My regular readers will know that I like to ponder out loud, my meandering musings in my blogs, so they won't be surprised I've come up with another quick quiz: Are you self-employed? If so,…