....for it is knell that summons thee to heaven or to hell." I know: not quite the cheerful entry to a blog, however, those immortal words from my favourite Shakespeare play: uttered by Macbeth on…

....for it is knell that summons thee to heaven or to hell." I know: not quite the cheerful entry to a blog, however, those immortal words from my favourite Shakespeare play: uttered by Macbeth on…

With the end of freedom of movement between the UK and EU from 1 January 2021, the UK has introduced an immigration system that treats all applicants equally. Anyone recruited to work in the UK…

As the third Covid-19 lockdown took effect on 5 January 2021, the Chancellor announced a further £4.6 billion in grants to the retail, hospitality and leisure sectors. This new round of support follows extensions to…

One of the announcements to come out of the Chancellor’s Spending Review was welcome increases to minimum wages. From 1 April 2021, the National Living Wage will get a 19p increase, going up to £8.91…

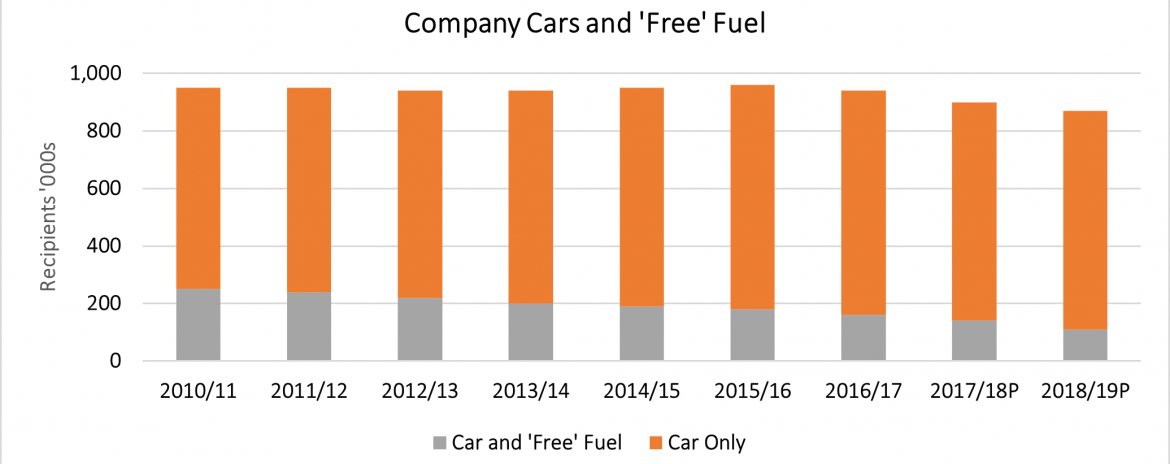

It's not often I get nostalgic, but every once in a while, I harken back to my days in the Revenue (now "HMRC") and in practice as a tax consultant; to a time when the…

With the announcement of another national lockdown, the furlough scheme has been extended for a further month from 1 November until 2 December. The extension of financial support under the Coronavirus Job Retention Scheme (CJRS)…

Following a recent consultation (December 2019), the Information Commissioner's Office has published its new detailed guidance on the Right of Access, Click here for further information on the background to the changes and modifications. Photo…

The latest pandemic support measures are much less generous than before. Despite cancelling this year's Autumn Budget, Rishi Sunak has still made an early autumn appearance before the House of Commons to announce his ‘Winter…

The tax treatment of cars and vans is quite different, with van classification far more beneficial from both an employer and employee perspective. However, the distinction is not always clear-cut, especially where vans have been…

With reports of two-thirds of furloughed employees continuing to work during the Covid-19 lockdown, despite the initial prohibition of work as an explicit condition of furlough, it is no surprise that HMRC has already written…