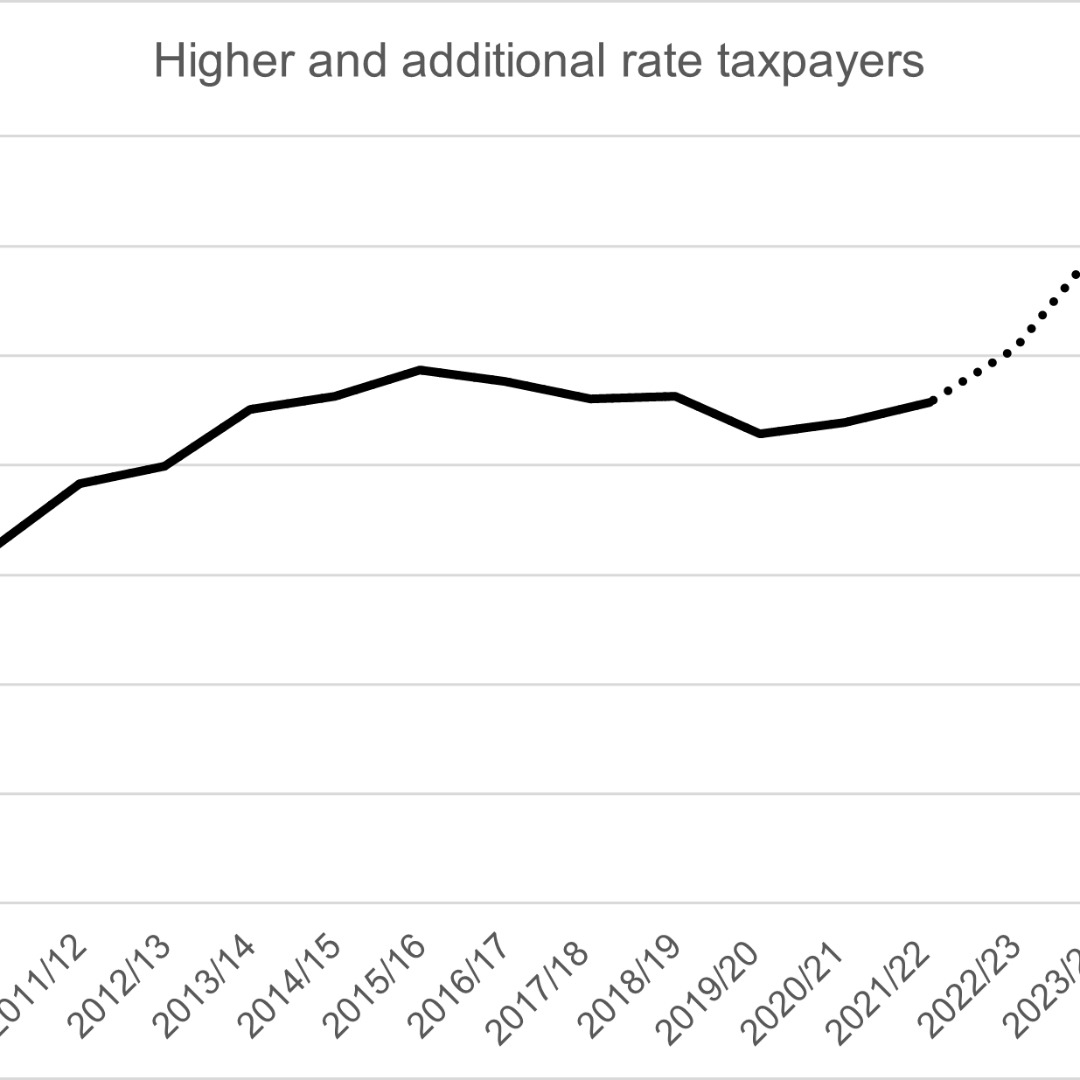

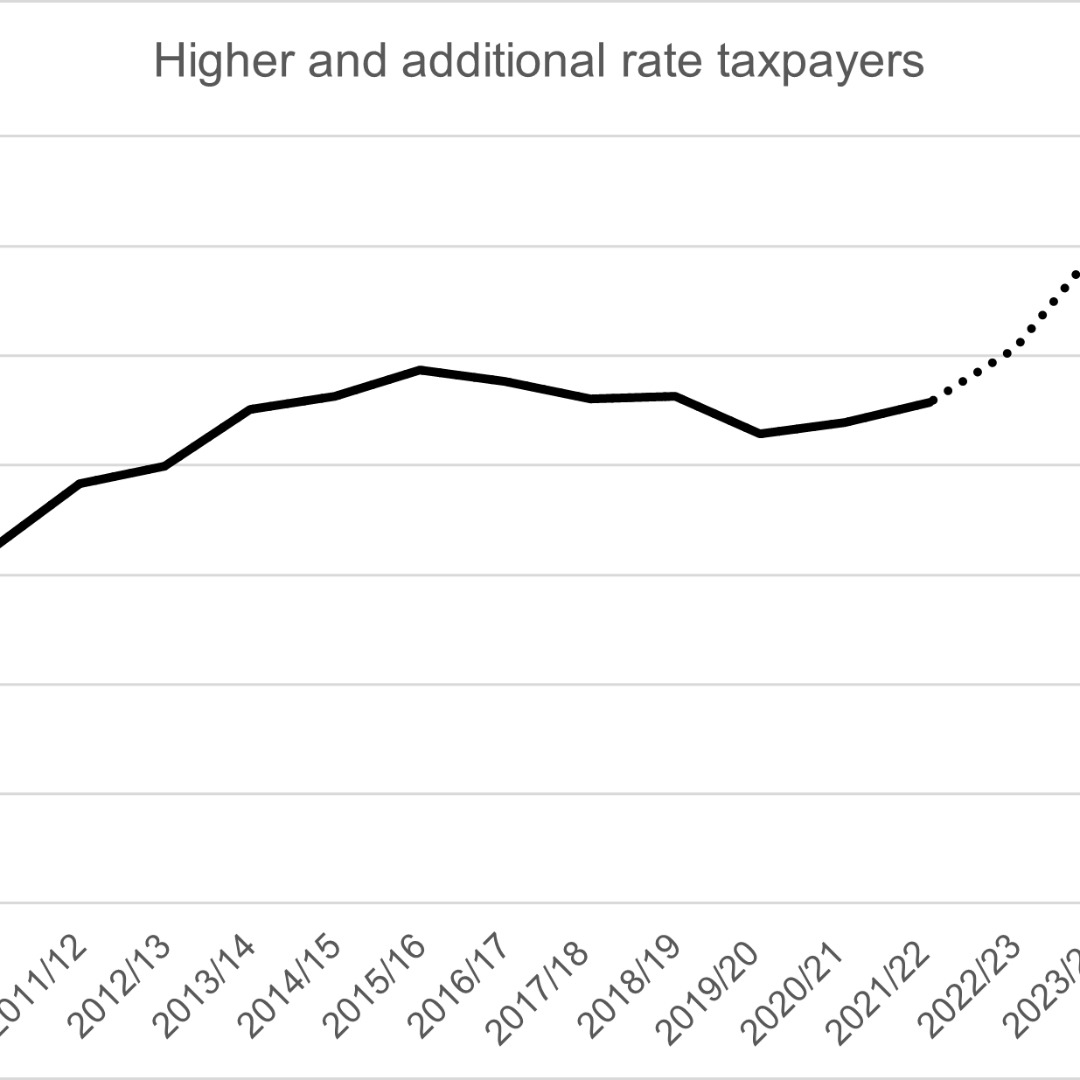

......and if that’s you, then advice is now more important than ever. There was once a time when paying tax at more than the basic rate made you a member of a somewhat select club.…

......and if that’s you, then advice is now more important than ever. There was once a time when paying tax at more than the basic rate made you a member of a somewhat select club.…

A critical review of how the government taxes child benefits has raised a major question mark over HMRC’s approach to collecting payments. Child benefit tax, or the High-Income Child Benefit Charge (HICBC) to use its…

An easy way to reduce a business’s tax bill – and also increase the amount of funds withdrawn from the business – is to put a family member on the payroll. Of course, the salary…

The Statutory Sick Pay Rebate Scheme (SSPRS), which ended on 30 September 2021, was reintroduced from 21 December 2021, with employers able to make retrospective claims from mid-January. The scheme’s return is in response to…

Larger employers can transfer up to 25% of their annual apprenticeship levy pot to support other, smaller, employers to take on apprentices in England. While there is nothing new about this, what is new is…

Five years after carrying out a consultation, the government is going to make it illegal for employers to withhold tips from workers. The change to legislation, due to take effect over the next 12 months,…

After playing a crucial part in managing the impact of Covid-19, the Coronavirus Job Retention Scheme (CJRS) is set to end on 30 September. Although some business sectors, such as hospitality, are currently seeing severe…

New government proposals target the promoters of national insurance contribution (NIC) avoidance schemes, while plans are in place to introduce a zero rate of employer contributions in Freeports. Both measures are included in the National…

Contractors have turned to umbrella companies as a hassle-free way of providing their services to clients following the recent changes to the off payroll working rules. They receive no tax savings, but pass on some…

HMRC’s official rate of interest has been cut from 2.25% to 2% from 6 April 2021. This will affect any directors or employees who have a beneficial loan from their employer, as well as directors…