New data from HMRC reveals there are now over six million people paying higher or additional rate tax in the UK. In recent years, the end of June has been the time for HMRC to…

New data from HMRC reveals there are now over six million people paying higher or additional rate tax in the UK. In recent years, the end of June has been the time for HMRC to…

The disposal of a private residence is exempt from capital gains tax (CGT) if used as a main residence throughout the period of ownership. A recent case heard in the First-Tier Tribunal has come up…

The widening scope of Making Tax Digital (MTD) is highlighting several issues, including the limited availability of the MTD for income tax pilot scheme, and low awareness of the recent expansion of MTD for VAT…

Many individuals donate to charity simply for altruistic reasons, but this doesn’t mean the tax benefit should be ignored. With Gift Aid donations saving tax at an individual’s marginal rate, donors need to watch out…

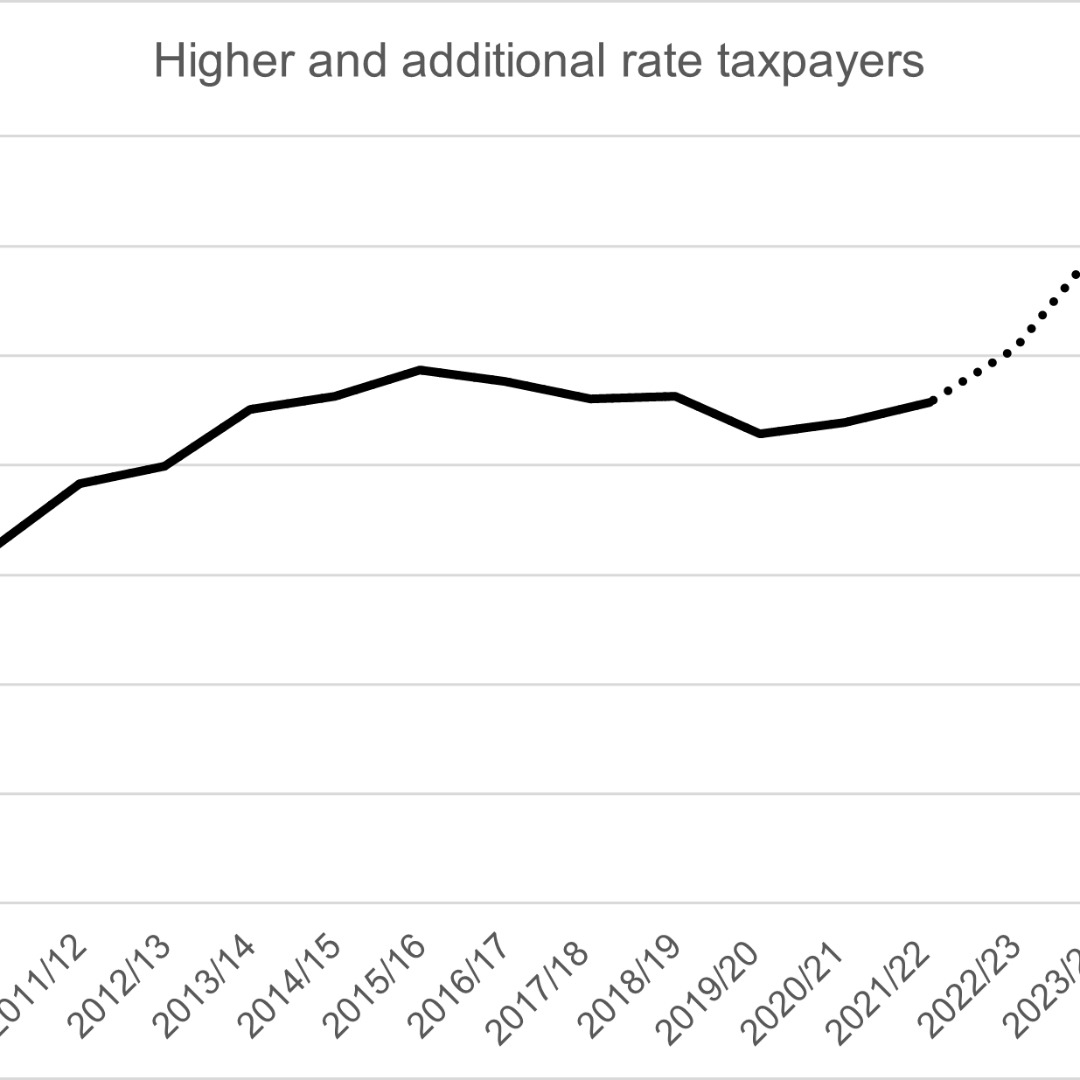

......and if that’s you, then advice is now more important than ever. There was once a time when paying tax at more than the basic rate made you a member of a somewhat select club.…

The pandemic has freed many workers from the confines of the office, leading to the emergence of a new breed of digital nomad – people who can take their laptop, jump on a plane and…

A critical review of how the government taxes child benefits has raised a major question mark over HMRC’s approach to collecting payments. Child benefit tax, or the High-Income Child Benefit Charge (HICBC) to use its…

Prior to the March Spring Statement, most self-employed individuals were facing increased national insurance contribution (NIC) bills this year. However, those with profits up to and just over £28,000 will now see a fall in…

Having a reasonable excuse can be a get-out-of-jail-free card if you are charged a tax penalty. However, there is no statutory definition of the term, and what might constitute a reasonable excuse for one person…

With the 2021 self-assessment tax return deadline on 31 January, HMRC has been busy reminding taxpayers to declare any Covid-19 grant payments they might have received. This is the first year they need to be…