The VAT domestic reverse charge will finally apply to most supplies of building and construction services from 1 March 2021. The rules, whose implementation have been postponed twice, cover standard and reduced rate VAT supplies…

The VAT domestic reverse charge will finally apply to most supplies of building and construction services from 1 March 2021. The rules, whose implementation have been postponed twice, cover standard and reduced rate VAT supplies…

Many businesses are struggling with the VAT regime in place since Brexit, especially when it comes to exporting goods to the EU. We address some of the common misunderstandings. Exporting goods Provided you have proof…

More support is available to help businesses in this latest lockdown, expected to last until at least 8 March. Keep up to date with, and claim, any support that your business is entitled to so…

The Wealth Tax Commission, an independent body of tax experts, has set out the framework for a one-off wealth tax. Will the Chancellor be tempted to adopt this? In his November [2020] statement, in which…

I'm sitting here musing about the number of calls I'm still taking from (potential) clients regarding taking them on for this year's self-assessment submissions. It's got me thinking. Why do some people leave this to…

As the third Covid-19 lockdown took effect on 5 January 2021, the Chancellor announced a further £4.6 billion in grants to the retail, hospitality and leisure sectors. This new round of support follows extensions to…

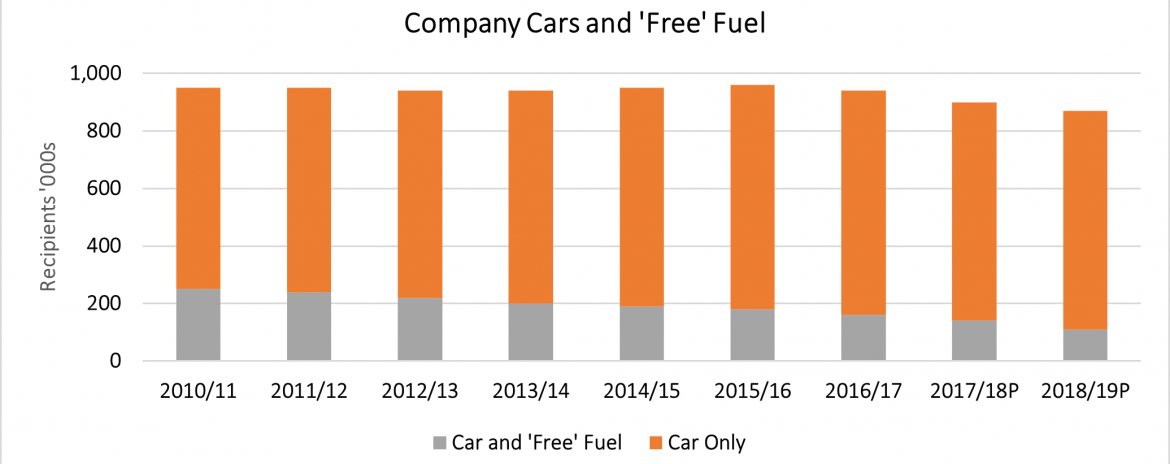

A recent report could herald changes to capital gains tax. Last July the Chancellor asked the Office of Tax Simplification (OTS) to undertake a review of capital gains tax (CGT) “in relation to individuals and…

One of the announcements to come out of the Chancellor’s Spending Review was welcome increases to minimum wages. From 1 April 2021, the National Living Wage will get a 19p increase, going up to £8.91…

Applications for the third Self-Employment Income Support Scheme (SEISS) grant opened from 30 November, and you have until 29 January 2021 to make a claim. Be warned, however, that some of the conditions for this…

It's not often I get nostalgic, but every once in a while, I harken back to my days in the Revenue (now "HMRC") and in practice as a tax consultant; to a time when the…