If an English or Welsh domiciled person dies without leaving a will, the amount that a surviving spouse or civil partner can inherit as a statutory legacy under the intestacy rules has – from 26…

If an English or Welsh domiciled person dies without leaving a will, the amount that a surviving spouse or civil partner can inherit as a statutory legacy under the intestacy rules has – from 26…

Hard on the heels of May's Sunday Times Rich List, will new proposals for a wealth tax gain any traction? In 2020, a group of economic research bodies set up the Wealth Tax Commission to…

HMRC is offering taxpayers named in the leaked Pandora Papers a chance to correct their tax affairs. The October 2021 leak involved almost 12 million documents revealing hidden wealth and tax avoidance. The papers revealed…

The normal time limit for a person to fill gaps in their national insurance (NI) record is six years, but transitional arrangements allow gaps to be filled back to 2006/07. The deadline for making such…

The combination of a frozen inheritance tax (IHT) nil rate band and considerably higher property values has pushed more estates into the IHT net. The average IHT bill is now nearly £62,000, with much larger…

The increased stamp duty relief for first time buyers has not been reversed by the new Chancellor, but it may not survive beyond the tax year. One of the few tax cuts to survive from…

Working through inheritance tax (IHT) requirements come at a difficult time. The provisions of the residence nil rate band (RNRB), which can be passed on between deceased spouses and civil partners, has caused some confusion.…

No fault divorce became a reality in April this year. Although it brought no associated changes to the tax rules, divorcing couples should now be in a better position to focus on financial issues –…

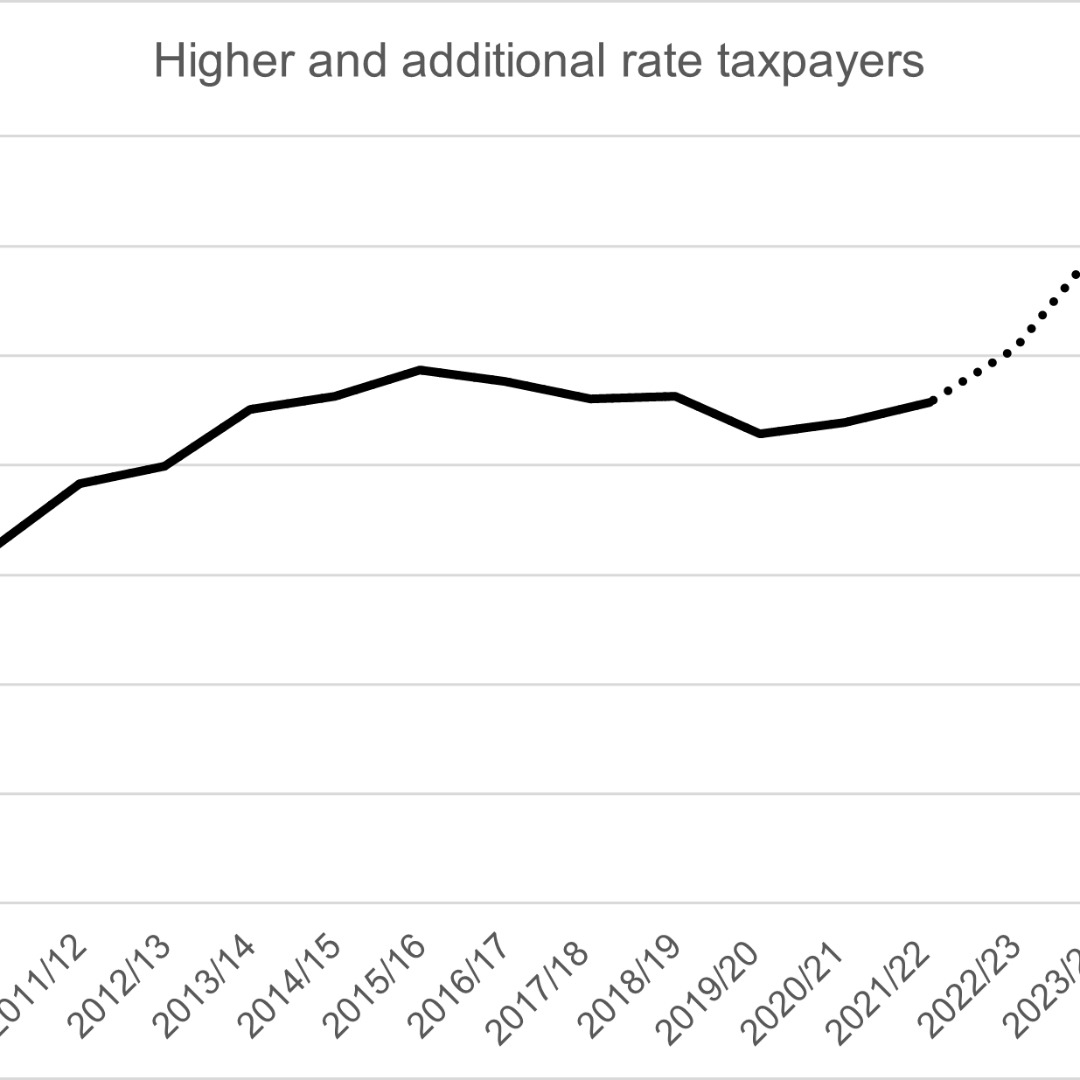

......and if that’s you, then advice is now more important than ever. There was once a time when paying tax at more than the basic rate made you a member of a somewhat select club.…

HMRC is sending letters to taxpayers who they believe hold cryptoassets, advising them of the potential capital gains tax (CGT) implications and linking to relevant guidance. Many taxpayers will be unaware that simply exchanging one…