From 6 April, employees now have the right to request flexible working from their first day at work. However, the right is still only to make a request and employers are under no obligation to…

From 6 April, employees now have the right to request flexible working from their first day at work. However, the right is still only to make a request and employers are under no obligation to…

From 1 June 2024, the abolition of multiple dwellings relief under stamp duty land tax (SDLT) will stop disputes about what qualifies as a separate dwelling (e.g. a granny annex). However, the scrapped tax will…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

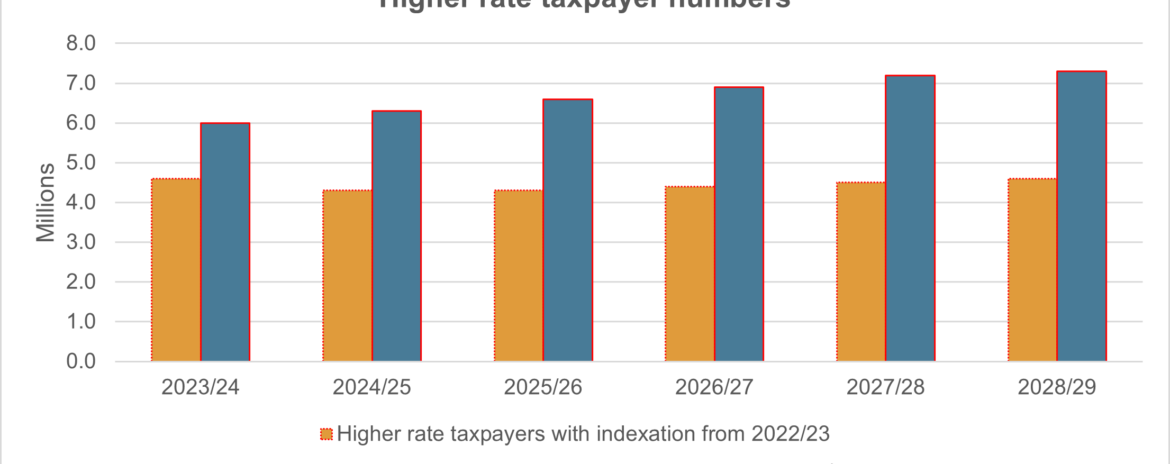

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

New research has put some surprising numbers on the income needed in retirement. Each year since 2019, the Pensions and Lifetime Savings Association (PLSA) has set about answering the question of how much retirement costs…

Perhaps not as widely known as the much publicised changes to company law is the fact that due to an increase in charges levied by Companies House, fees associated with incorporating and maintaining a company…

There’s no respite for HMRC with inheritance tax (IHT) accounts, undeclared dividend income and gains from share disposals to scrutinise. HMRC is currently busy with several ongoing checks. They are looking at IHT accounts, targeting…

What was almost certainly the last Budget before the election was a serving of the widely expected, sprinkled with a handful of small surprises. The Chancellor of the Exchequer, Jeremy Hunt, delivered the Spring Budget…

The introduction of a £500 income exemption from 6 April 2024 will impact many trusts. It comes with various complications, especially as income within the £500 exemption will still be taxable in the hands of…