At a point during the early days of the pandemic, this author, being of a certain age, weight, and ethnic group, took the decision to get his affairs in order – the Coronavirus intensely on…

At a point during the early days of the pandemic, this author, being of a certain age, weight, and ethnic group, took the decision to get his affairs in order – the Coronavirus intensely on…

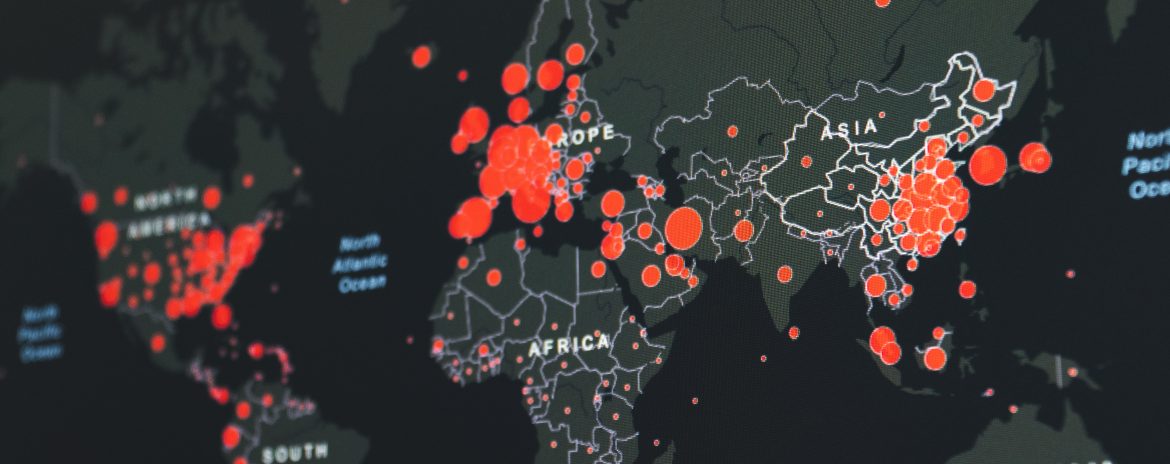

The global COVID-19 pandemic may be with us for a while yet and as such, I would like to take the opportunity to assure my clients (and potential clients) that as my practice is cloud-based,…

The government committed to undertake a fundamental review of business rates in England at the Spring Budget. It has now issued a call for evidence, with views on reliefs and the ‘multiplier sort’ by 18…

The COVID-19 pandemic stalled property transactions and first-time buyer mortgage applications, but now the residential property market has opened up estate agents are scrambling to deal with pent up demand. Price outlook The range of…

A new Corporate Insolvency and Governance Bill, introduced on 20 May, will amend insolvency and company law to support businesses in distress from the impact of the COVID-19 pandemic. The Bill, to be fast-tracked through…

HMRC’s recent suspension of IHT investigations during the Covid-19 crisis opens up a brief opportunity for executors to get their IHT accounts in order. HMRC normally investigates around 5,500 IHT cases every year, around 25%…

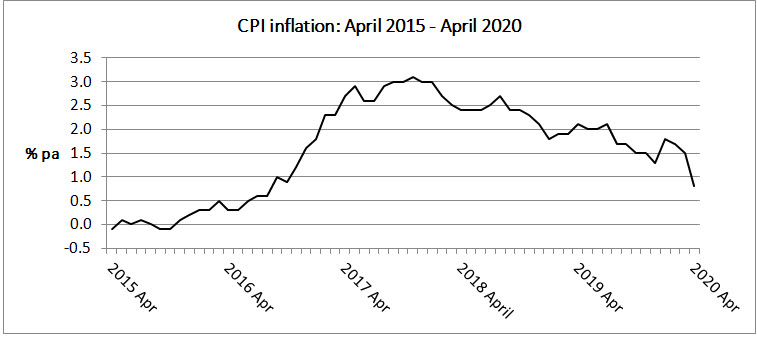

The disappearance of normal spending habits has created problems for the statisticians who calculate the rate of inflation. Source: Office for National Statistics Inflation, as measured by the Consumer Prices Index (CPI), fell sharply in…

HMRC is allowing your second self-assessment payment due on 31 July 2020 on account for the tax year 2019/20 to be deferred, due to the Covid-19 pandemic. This means no interest or penalties will be…

The adoption in the UK of a transatlantic approach to income tax could appeal to a cash-strapped Chancellor. “…only the little people pay taxes.” That 1980s comment by the New York Hotel owner Leona Helmsley…

The Covid-19 furlough scheme has been effectively revised into a new scheme running from 1 July until 31 October, but this comes with a level of complexity that did not exist in its original guise.…