It’s estimated roughly 100,000 people a year enter one form of formal personal insolvency or another and Covid-19 is likely to significantly increase this figure. This article is written in the hope that it may provide comfort to some and encourage others to avoid the potholes the content deals with.

Every so often a new client is referred to me for assistance with a challenge in dealing with debt owed to HMRC, and typically, I get the introduction when HMRC’s Debt Management team has stepped in to either collect the unpaid taxes or refer the matter for enforcement action which mostly means the matter has escalated to the point of threats of a statutory demand, bankruptcy proceedings or winding up petition.

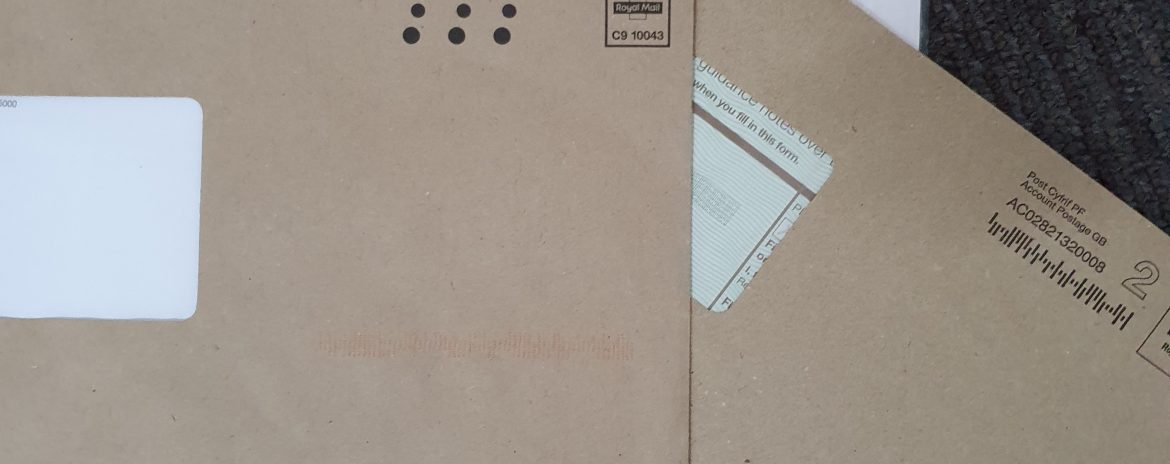

There are usually, two main reasons why escalation kicks in: either HMRC is playing hard-ball and not giving the client time to settle the liability or more often than not; the client has suffered from what I like to call “Brown Envelop Syndrome” or BES for short. Not a new term, I’m sure. A quick search of googles reveals tons of articles on this subject; I’m probably not discussing anything new here, but I’ll continue anyway as this is a live and topical issue for many.

Some of you out there may no sympathy for BES sufferers whatsoever, after all, they earned (or in the case of PAYE and VAT, collected) the money and should (when due) pay what is owed. I don’t disagree with you on this but, having dealt with scores of ‘sufferers’, I can assure you this is a real (if not medically diagnosed) ailment – suffered by hundreds of thousands of individuals across the UK. And, like COVID-19, it has no respect for gender, race, religion, politics, football club or anything else we human beings use to differentiate ourselves from others.

The ailment starts with the receipt of, and you will not be surprised to hear this: the arrival of a brown envelope.

Approaching the floor mat with trepidation, then separating out the brown envelope(s): the former opened almost immediately, the latter either opened at a future date or in some instances, not at all. The problem with BES is that despite ignoring the content of the envelope, and wishing the problem will go away, the fact of the matter is credit card bills, HMRC demands, utility bills etc don’t go away because we ignore them. They only attract further demand, the accrual of interest, the arrival of debt collectors, or threats of county court judgements.

Back to my clients – sometimes an individual, often a company. Having finally opened the envelopes and read through the various correspondence from the creditor, I break the bad news to the client on the quantum of the debt owed, and this is then followed a conversation on how best to resolve the matter is had, after which I am engaged to correspond with the creditor to put in place a repayment arrangement, stop any enforcement action and provide my client with the peace of mind in knowing that the tax liability is not going to lead to a county court judgement, an adverse credit rating or insolvency (personal or commercial).

So, if you are a BES sufferer and have a pile of brown envelopes stashed away somewhere. Do not panic, and most importantly: do not ignore them. Set aside your dread and trepidation and go retrieve them, then give me a call on 01925 937 499, or email me at femi@lofusstowe.com or, if you’re really feeling brave; book an initial consultation with me at: https://calendly.com/femiogunshakin