HMRC’s official rate of interest has been cut from 2.25% to 2% from 6 April 2021. This will affect any directors or employees who have a beneficial loan from their employer, as well as directors…

HMRC’s official rate of interest has been cut from 2.25% to 2% from 6 April 2021. This will affect any directors or employees who have a beneficial loan from their employer, as well as directors…

HMRC’s official rate of interest has been cut from 2.25% to 2% from 6 April 2021. This will affect any directors or employees who have a beneficial loan from their employer, as well as directors…

By setting up an online childcare account, you can get a government top-up to help with the costs of childcare. However, thousands are missing out on this payment. Tax-free childcare is worth up to £500…

To assist taxpayers, HMRC has launched an online portal for the making of working from home expenses incurred during the pandemic. From 6 April 2020, employees can claim a tax-free amount of £6 a week…

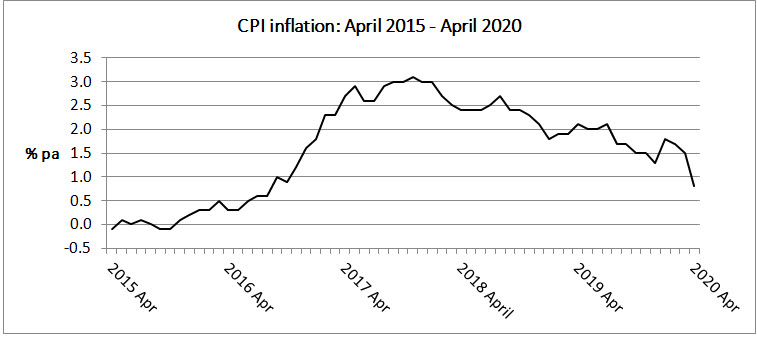

The disappearance of normal spending habits has created problems for the statisticians who calculate the rate of inflation. Source: Office for National Statistics Inflation, as measured by the Consumer Prices Index (CPI), fell sharply in…

The state pension triple lock may not survive much longer. The impact of Covid-19 on earnings could mean a change in the way that state pensions are increased in each year. If nothing is done,…

Help for consumers to manage their credit and debt has been extended to the end of October. In mid-June, the Financial Conduct Authority (FCA) told firms to extend measures to provide help to people with…