Recently published statistics show that the company car is making something of a comeback, with the number of recipients for 2023/24 up 80,000 from the previous year. From a high of 960,000 company car recipients…

Recently published statistics show that the company car is making something of a comeback, with the number of recipients for 2023/24 up 80,000 from the previous year. From a high of 960,000 company car recipients…

The latest estimate of the tax gap shows that missing taxes are approaching £46.8 billion, with some 5.3% of total taxes going unpaid. These figures are for 2023/24. HMRC will be particularly concerned that small…

Company directors need to be aware of important changes to be implemented by Companies House from 1 April 2027. Digital software Directors who submit their company accounts themselves, rather than using an agent, will no…

It’s not often we ask directors to personally fund costs of legal services following the issue of a winding up petition, but it is a necessary move given s.127(1) of the Insolvency Act 1986. For…

Identity verification is being introduced for directors, people with significant control (PSC) and those who file at Companies House. Verification is currently voluntary, but will be made mandatory from this autumn. From autumn 2025, mandatory…

The start of the new tax year warrants as much planning as the end of the old tax year. While the end of the tax year on 5 April is a major focus of tax…

Starting with the 2025/26 tax year, directors of close companies (owner-managed companies) will need to separate the dividend income received from their companies. This change will have an impact on almost 900,000 directors. In very…

Thresholds defining company sizes have not changed since 2016, but revised thresholds are now set to be introduced from 6 April 2025. Companies House intends to roll out their new identity verification requirements for directors…

With the dividend allowance now cut to just £500, the number of taxpayers paying tax on dividend income for 2024/25 is expected to be double what it was three years ago. Previously set at £2,000,…

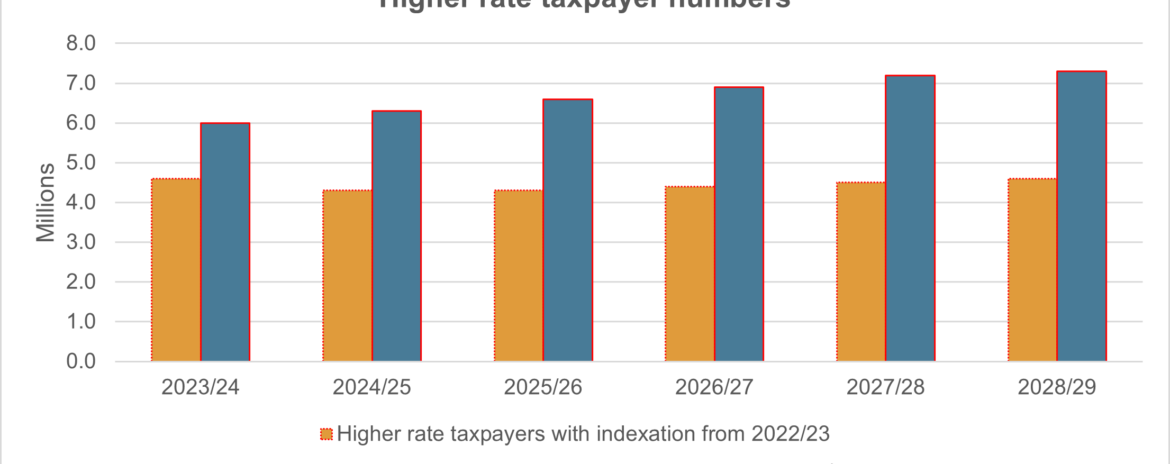

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…