With allowances frozen or cut, you may have underpaid tax for 2023/24. Your tax position may have changed for the last year without you really noticing. Consider the following: Tax Year 2021/22 2023/24 2024/25 Personal…

With allowances frozen or cut, you may have underpaid tax for 2023/24. Your tax position may have changed for the last year without you really noticing. Consider the following: Tax Year 2021/22 2023/24 2024/25 Personal…

While the higher rate of capital gains tax (CGT) on residential property disposals has dropped by 4%, from 28% to 24%, from 6 April 2024, the vast majority of landlords who sell up are facing…

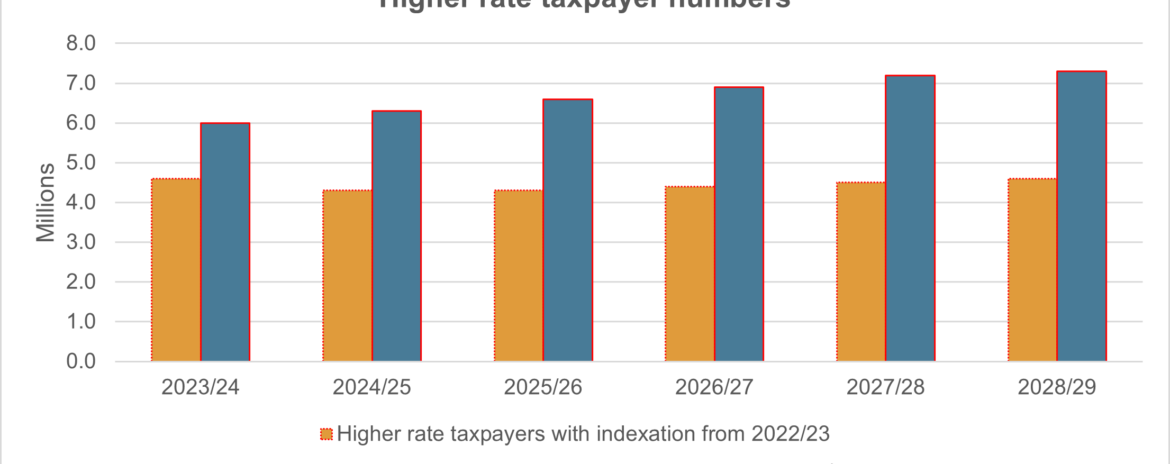

New calculations issued alongside the Spring Budget show just how higher rate taxpaying status is becoming ever more common. The Office for Budget Responsibility (OBR) received plenty of attention leading up to the Budget. It…

The media storm surrounding HMRC taxing eBay and other online sellers from the start of 2024 was, in fact, itself counterfeit goods. A crop of stories across social and traditional media swirled across the start…

With tax bands and other thresholds frozen, taxpayers should be aware of the implications of their income increasing. Increased income can mean more than facing a higher tax bill. Higher rate taxpayers need to look…

From 2024/25, restrictions to the cash basis will be removed, making it the default method for calculating trading profit for the self-employed and most partnerships. The accruals basis is currently the default, with a business…

National insurance contribution (NIC) changes for the self-employed announced in the Autumn Statement come in from 6 April 2024 and will be welcome news. But the reforms don’t go far enough to offset the continuing…

The Bank of England base rate increase is impacting on the government’s tax takes, with more taxpayers paying tax on savings income due to higher interest rates. Increased mortgage rates are contributing to rocketing capital…

HMRC is chasing taxpayers who have submitted tax returns for 2021/22 containing unresolved provisional figures, while also extolling the benefits of filing early for 2022/23. What are provisional figures? A provisional figure is not the…

New income tax statistics from HMRC appear to be good news, but the numbers are not what they seem. Taxpayer’s marginal rate Basic Rate Higher Rate Additional Rate 2020/21 Average tax rate 9.5% 21.8% 38.3%…